Income tax reform bill passes first House committee

SANTA FE, N.M. – Taxes aren’t the most exciting things to talk about, but it could be good news for some taxpayers if House Bill 252 goes through.

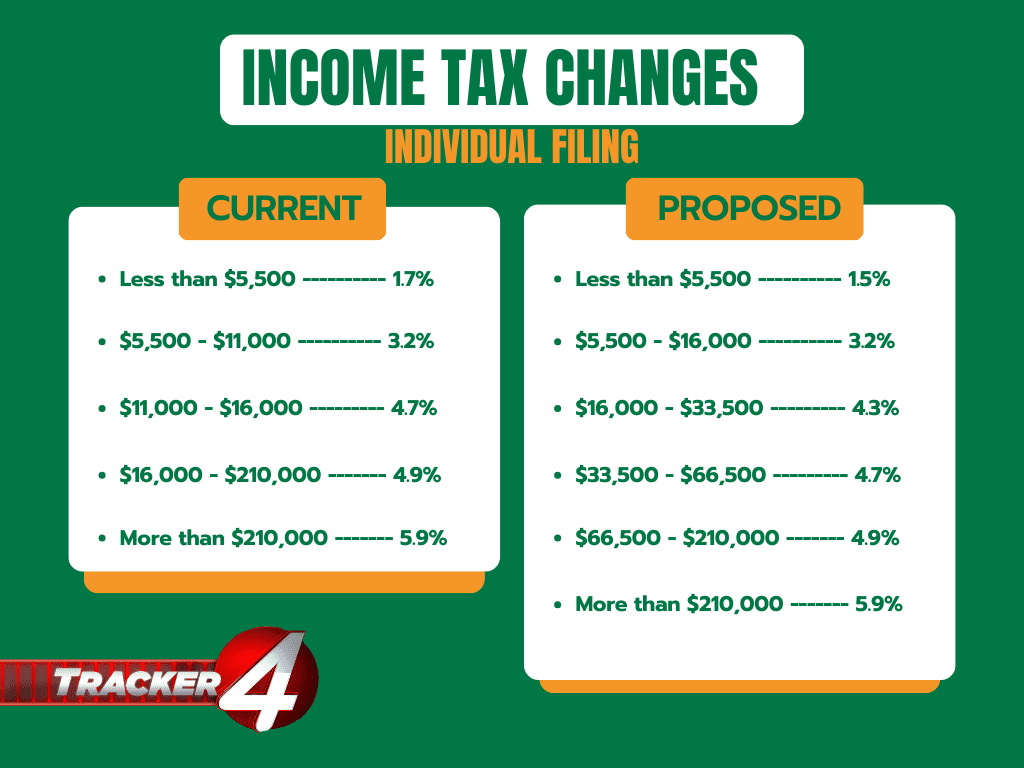

The current state income tax breakdown has five brackets. Anyone making $16,000 to $210,000 a year are paying the same income tax rate.

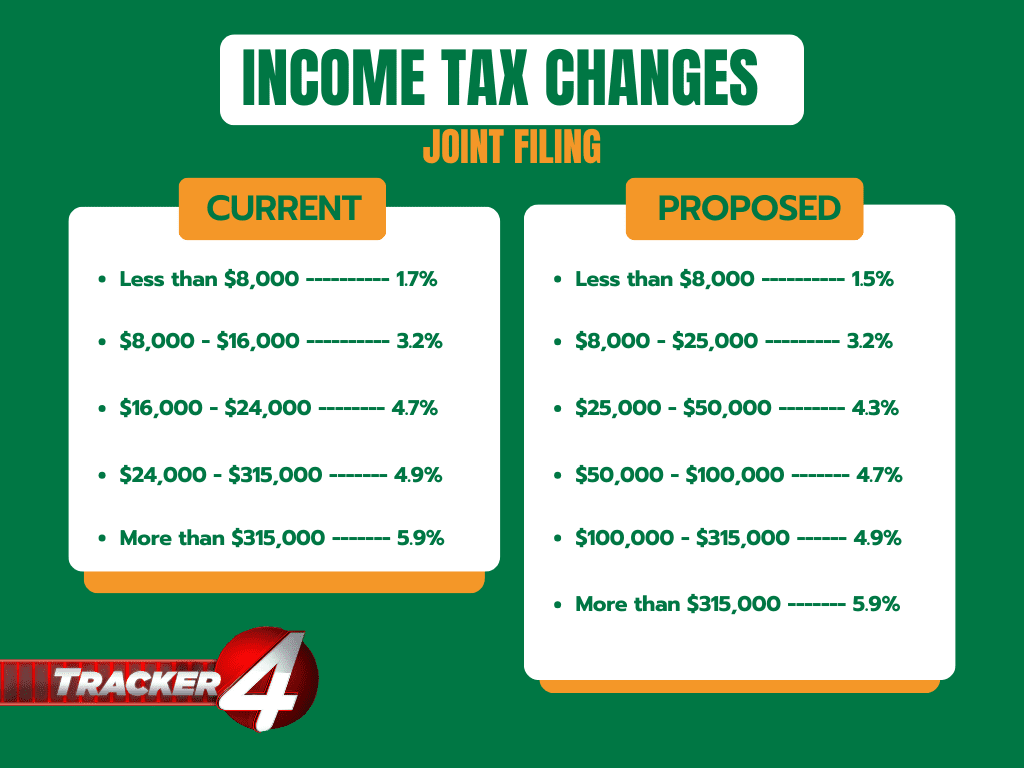

Joint filers have an even bigger range of $24,000 to $315,000 at 4.9%. Some lawmakers want to break up those brackets.

“This tax proposal, which is the same thing as last year, takes into account that we are looking to achieve the best outcome for those that are at the lower to middle of the tax income brackets,” said state Rep. Derrick Lente.

Here are the proposed changes:

There would be more brackets for joint filers, and adds a 4.3% rate. The brackets are spread out more evenly, and there’s a lower tax rate for the state’s lowest earners. It’s the same thing for individual filers.

The average income in New Mexico is around $30,000. Right now, that puts you in the second-highest tax bracket at 4.9%. This bill would drop you two brackets to 4.3%.

The bill unanimously passed its first House committee Monday. Last year, it had bipartisan support all the way to the governor’s desk, where she vetoed it.

Sponsors are hoping for a different outcome this session.

“She is the one that killed it last year, and so I can say that I’ve talked with staff of the governors. And so at this point in time, I have no indication that she could not appreciate giving tax incentives for working class New Mexicans,” said Lente.

KOB 4 spoke with a tax expert Monday. He says this current structure has been in place since 2003, and it’s pretty much a flat tax system where most people are paying the same rate, which hurts lower earners more.

What he really liked about the new layout is there are no “losers” as he put it, meaning no one’s taxes increase. But it does have one downside.

“No one would be offended by this bill, or almost no one is just, you know, it comes with a price tag. It’s probably the right thing to do in terms of restructuring our brackets, that that makes some sense,” said Richard Anklam, president and executive director of the New Mexico Tax Research Institute.

That price tag is an approximate $180 million in income tax the state would not get next year.

The Legislative Finance Committee already determined lawmakers have a $200 million to $300 million range in lost taxes before it becomes troublesome. This proposal fits those parameters, but there’s not much wiggle room.