New Mexico House approves tax package, update to income tax brackets

SANTA FE, N.M. — A massive tax package just crossed the halfway point at the Roundhouse after several hours of debate on the House floor.

Members of the House Taxation & Revenue Committee say this year’s tax package includes a lot of things from last year that were vetoed by the governor, and insisted this version should be un-vetoable.

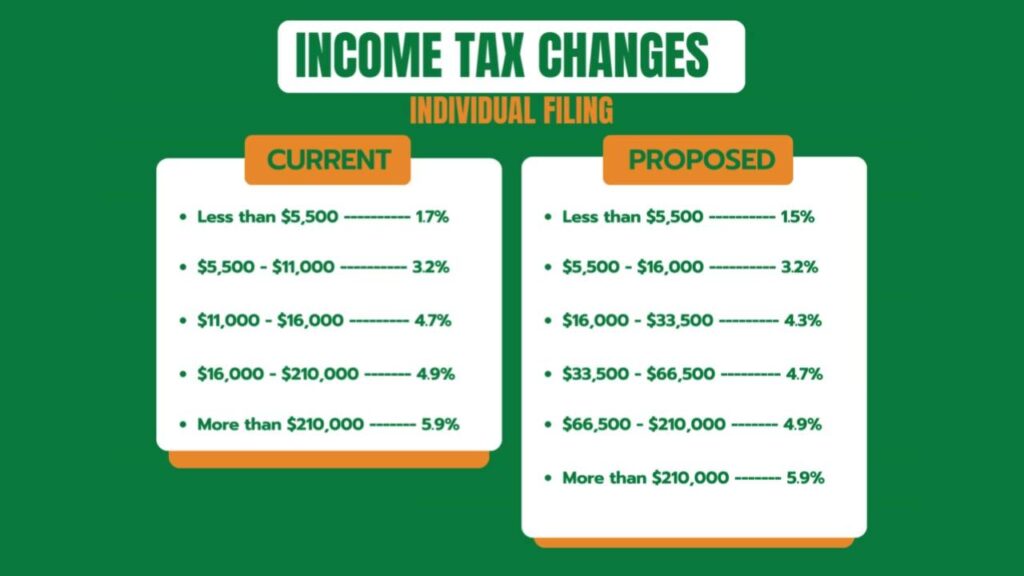

The proposal includes tax credits for energy storage, rural health care practitioners, and even New Mexicans who lost their homes in some recent wildfires. The big ticket item is a major update to the state’s income tax brackets.

Right now, individual taxpayers earning anywhere between $16,000 and $210,000 a year are taxed at the same rate. Lawmakers want to break that into three different brackets, while also slightly lowering the tax rate for the majority of New Mexicans. It’s a similar plan for joint filers.

Lawmakers predict most families can expect up to $200 in savings, but some Republicans said that’s not enough. They proposed lowering everyone’s tax rate to just 1%, considering the state has billions of dollars in oil and gas money to work with.

Lawmakers quickly noted that plan would cost the state $2 billion, while the current proposal only costs around $180 million – and that’s already accounted for in the state budget proposal, along with major funding boosts for every state department.

Lawmakers rejected that plan from Republicans and eventually approved the full tax package with bipartisan support.